Lofdal is the most advanced project in the Company portfolio with a 43-101 mineral resource estimate established in 2012 which was updated in 2021 and a Preliminary Economic Assessment (“PEA”) completed in 2014. In 2016 Namibia Rare Earths Inc. (predecessor company to NMI) completed an Environmental Impact Assessment and was granted an Environmental Clearance Certificate from the Ministry of Environment and Tourism in 2017. In December 2020 the Company received a Notice of Preparedness to Grant Application for Mining Licence from Ministry of Mines and Energy and Mining License ML 200 was subsequently granted in July 2021. ML200 is valid for a 25-year period through to May 10, 2046 and is issued to the Company’s 95% owned subsidiary, Namibia Rare Earths (Pty) Ltd. with the balance held by Philco One Hundred Ninety-Six (Pty) Ltd. (“Philco 196”), a company incorporated to fulfil the licence requirement of a 5% shareholding of Historically Disadvantaged Namibians.

Partnership with JOGMEC on Lofdal

On January 27, 2020 the Company announced that it had signed an agreement with Japan Oil, Gas and Metals National Corporation (“JOGMEC”) to jointly explore, develop, exploit, refine and/or distribute mineral products from Lofdal. The agreement provides JOGMEC with the right to earn a 50% interest in the project by funding $20,000,000 in exploration and development expenditures under the following terms:

Term 1 – JOGMEC will fund $3,000,000 in exploration expenditures up to March 31, 2021. The first term funding amount is non-refundable and JOGMEC earns no interest in the Lofdal project;

Term 2 – JOGMEC is entitled to elect to contribute an additional $7,000,000 in exploration expenditures from April 1, 2021 – March 31, 2024 to earn a 40% interest in the Lofdal project;

Term 3 – JOGMEC is entitled to elect to contribute an additional $10,000,000 in exploration and development expenditures from April 1, 2024 – March 31, 2028 to earn an additional 10% interest in the Lofdal project.

Once JOGMEC has completed and exercised its 50% earn-in and a feasibility study has been completed on the project, JOGMEC has the right to purchase an additional 1% interest in the project from the Company for $5,000,000 and thereafter to exclusively provide funding to develop the project subject to the Company’s interest in the Project not being diluted below 26%.

JOGMEC is a Japanese government independent administrative agency which among other things seeks to secure stable resource supply for Japan. JOGMEC has a strong reputation as a long term, strategic partner in mineral projects globally. The mandated areas of responsibilities within JOGMEC relate to oil and natural gas, metals, coal and geothermal energy. JOGMEC facilitates opportunities with Japanese private companies to secure supply of natural resources for the benefit of the country’s economic development.

Rare earths are of critical importance to Japanese industrial interests and JOGMEC has extensive experience with all aspects of the sector. JOGMEC provided Lynas Corporation with US$250,000,000 in loans and equity in 2011 to ensure supplies of these crucial metals from the Mount Weld Project in Australia to Japanese industry.

Japan is the most important consumer of dysprosium outside of China. Adamas Intelligence estimates that from 2013 through 2017 China produced 98% of the global supply of dysprosium and was responsible for approximately 90% of global dysprosium oxide (or oxide equivalent) consumption each year. Japan was responsible for 9% of global consumption and other nations (including the United States) for 1%. With 2017 dysprosium production estimated at 1,500 tonnes, Japanese consumption is estimated at 160 tonnes per annum.

Regional Assessment of Rare Earths Potential

The first systematic exploration for rare earths over Lofdal was initiated by Namibia Rare Earths Pty in 2008. In 2011 the Area 4 heavy rare earth deposit was discovered and since that time exploration results have demonstrated the occurrence of rare earth mineralization on a district scale (Figure 2).

Rare earth mineralization at Lofdal is hosted in carbonatite dykes, structural zones and plugs exhibiting grades between 0.05-3% total rare earths oxides (“TREO” which includes yttrium oxide) and often exhibiting exceptional heavy rare earth (“HREE”) grades.

The Company uses classification nomenclature which considers heavy rare earths comprising europium (Eu), gadolinium (Gd), terbium (Tb), dysprosium (Dy), holmium (Ho), erbium (Er), thulium (Tm), ytterbium (Yb), lutetium (Lu) and yttrium (Y). Light rare earths comprise lanthanum (La), cerium (Ce), praseodymium (Pr), neodymium (Nd) and samarium (Sm). “Heavy rare earth enrichment” is the ratio of HREO:TREO, expressed as a percentage.

Mineralization at Area 4 is associated with large scale hydrothermal systems. Many of the larger, lower grade “dykes” previously mapped on surface are in fact alteration zones associated with these systems which in some areas significantly increases the strike and width potential of the heavy rare earths exploration target.

There are two larger intrusive carbonatite bodies related to a specific magmatic phase combined as Lofdal Intrusive Complex. The Main Intrusion is an early stage calcitic body some two kilometers in strike length which does not carry significant amounts of rare earths but has potential for niobium and uranium mineralization. The smaller Emanya plug is some 350 meters in diameter in outcrop and carries anomalous concentrations of rare earths typically in the range of 0.2-1% TREO but is not enriched in heavy rare earths.

Detailed mineralogical studies have confirmed that the principal heavy rare earth mineral at Lofdal is xenotime. The potential ore mineral assemblage has accessory thorite with an average thorium content of the Area 4 deposit of only 326 ppm.

Grain size and habit are variable with ore minerals being generally fine- to very fine-grained with much of the potential ore minerals averaging 15-20 microns but locally reaching up to 150 microns.

Figure 1 – General geology of EPL 3400 showing the location of the Area 4 and Area 2B Deposits in relation to other structures with rare earth mineralisation

Drilling Program (2020)

Drill target areas identified at Lofdal for resource development are shown in Figure 2.

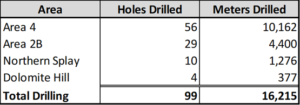

Drilling in 2020 focused on extending the mineral resource in Area 4 and confirming the resource potential in Area 2B. Reconnaissance drilling on the Northern Splay and Dolomite Hill targets did not return significant results for resource development.

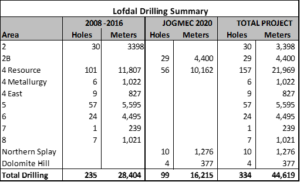

Total drilling completed for the Term 1 program is summarized as follows:

Figure 2 – Drill target areas at Lofdal for resource development. In 2020-2021, focus was on Area 4. Area 2B is the first satellite deposit with resource drilling.

Updated Mineral Resource 2021

The MSA Group (“MSA”) of South Africa was engaged to update the Lofdal resource which incorporated all the new drilling from Area 4 and Area 2B. As part of its due diligence process, MSA completed a site visit to review all technical aspects of the project including the Company’s standard operating procedures and quality assurance quality control (“QAQC”) programs. Considerable time was dedicated to vetting the geological model and continuity of the mineralization. Field operations follow strict company Standard Operating Procedures with regards to drilling practices, sampling procedures, security of transport and analytical procedures as per recommendations in the Canadian Institute of Mining, Metallurgy and Petroleum CIM’s Best Practices Guidelines (2018), which includes strict internal QAQC procedures for the insertion of blanks, standards and duplicates. QAQC samples account for 10% of samples submitted in each batch. Sample preparation and analytical work for the drilling program is being provided by Activation Laboratories Ltd. (“Actlabs” Windhoek, Namibia and Ancaster, Ontario). Actlabs is an ISO/IEC 17025 accredited laboratory.

The Mineral Resource estimate was based on geochemical analyses and density measurements of core samples obtained by diamond drilling undertaken by Namibia Rare Earths from 2010 to 2012, 2015 and by Namibia Critical Metals from 2020 to 2021.

A total of 172 drill holes have been drilled at Area 4, of which 13 were collared outside the defined Mineral Resource. In Area 2B, 46 drill holes were used to estimate the Mineral Resource.

Half core samples of one-meter lengths intervals were taken for analysis. The bagged core samples were given a unique sample reference number and dispatched for preparation at Activation Labs (Actlabs) sample preparation facility in Windhoek. The core samples were crushed to 2 mm, split using a riffle splitter and pulverised to 105 µm. Pulverised sub-samples were homogenised in a stainless-steel riffle splitter and a 15 g sample and duplicate were drawn for analysis. The pulverised sample aliquots were shipped to the ISO/IEC 17025 accredited Actlabs analytical facility in Ancaster, Ontario, Canada. The REE’s were assayed using lithium metaborate-tetraborate fusion and Inductively Coupled Plasma Mass Spectrometry (ICP-MS).

The samples were subjected to a quality assurance and control (QAQC) program consisting of the insertion of blank samples and certified reference materials at Lofdal and the preparation of a laboratory duplicate at the sample preparation facility in Windhoek. The primary laboratory assay values were confirmed by duplicate samples assayed by a second laboratory (ALS, North Vancouver, Canada). MSA was satisfied that the assay results are of sufficient accuracy and precision for use in Mineral Resource estimation.

A three-dimensional geological model of the REE mineralisation and weathering surface was constructed using the drill hole and trench data. A mineralised envelope was defined using a 10 ppm Dy2O3 threshold for Area 4 and 12 ppm Dy2O3 for Area 2B. The grades of the individual light rare earth oxides (LREO) and individual heavy rare earth oxides (HREO) were estimated using ordinary kriging into a block model for each deposit. Density was estimated using inverse distance weighting.

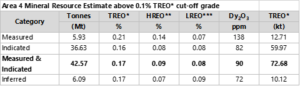

From the assumed parameters a 0.1% TREO cut-off grade was calculated, which together with the Whittle optimised pit shell demonstrates reasonable prospects for eventual economic extraction (RPEEE) for the Mineral Resource. The Mineral Resource is classified into the Measured, Indicated and Inferred categories and is reported at a cut-off grade of 0.1% TREO (TREO refers to Total Rare Earth Oxides including Y2O3). The independent resource for Area 4 and for Area 2B was estimated by MSA as follows:

Area 4 Mineral Resources Estimate for 0.1% TREO cut-off

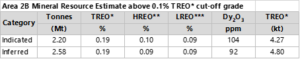

Notes (also apply to Area 2B resource statement):

- All tabulated data have been rounded and as a result minor computational errors may occur.

- Mineral Resources, which are not Mineral Reserves, have no demonstrated economic viability.

- Quantities reported are the total quantities for the project regardless of ownership.

- *TREO = Total Rare Earth Oxides and includes Y2O3

- **HREO = Heavy Rare Earth Oxides and includes Y2O3

- ***LREO = Light Rare Earth Oxides

- Mt = Million tonnes, kt = Thousand tonnes.

Area 2B Mineral Resources Estimate for 0.1% TREO cut-off

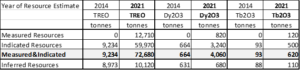

Table 3: Comparison of Lofdal Mineral Resource Estimates of 2012 and 2021

| Year of Mineral Resource Estimate | 2012 | 2012 | 2021 | 2021 |

| Cut-off grade | 0.1% TREO | 0.1% TREO | 0.1% TREO | 0.1% TREO |

| Million tonnes

(Mt) |

Grade

%TREO |

Million tonnes

(Mt) |

Grade

%TREO |

|

| Measured Resource Area 4 | 0 | – | 5.93 | 0.21 |

| Indicated Resource Area 4 | 2.88 | 0.32 | 36.63 | 0.16 |

| Indicated Resource Area 2B | 0 | – | 2.20 | 0.19 |

| Total Measured & Indicated Resources | 2.88 | 0.32 | 44.76 | 0.17 |

| Inferred Resource Area 4 | 3.28 | 0.27 | 6.09 | 0.17 |

| Inferred Resource Area 2B | 0 | – | 2.58 | 0.19 |

| Total Inferred Resources | 3.28 | 0.27 | 8.67 | 0.17 |

Table 5: Contained dysprosium oxide and terbium oxide in Mineral Resources of 2012 and 2021

Potential to Expand Resources at Lofdal

There are a number of other rare earth occurrences on ML200 and EPL3400 (see Figure 2). Exploration drilling was carried out in Area 5 in 2011 but no resources have been estimated. Based on the company’s recently refined geological model Area 5B-E and Area 2A-C are regarded as the exploration targets with the highest potential to add significant resources by limited drilling.

Lofdal Preliminary Economic Assessment 2B-4 October 2022

The company finalised the financial analysis of its Preliminary Economic Assessment (“PEA”) “2B-4”. This PEA aims at a significantly larger annual run-of-mine and plant throughput of 2 million tonnes per year and longer mine life than the historical PEA of 2014 by mining from two sub-deposits namely “Pit 2B” and “Pit 4”. Further, the processing flow sheet was simplified to a direct flotation of the run-of-mine material and expanded to include a hydrometallurgical unit producing a >98% mixed rare earth oxide as final product (see above) instead of xenotime concentrate.

*Cautionary Note: The preliminary economic assessment is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them to enable them to be categorized as mineral reserves and there is no certainty that the preliminary economic assessment will be realized. Mineral resources that are not mineral reserves do not have a demonstrated economic viability

Economic Analysis

SGS Canada provided the capital costs for the expanded project Lofdal “2B-4” totalling to about USD207 million.

| Table 7 – Total Capital Costs Summary (US$) | ||

| Direct Mining Costs1 | – | |

| Direct Mine Site Processing Costs | 117,577,231 | |

| Direct Tailings Storage Facility Costs | 13,628,361 | |

| SUB TOTAL INITIAL CAPITAL COSTS | 131,205,593 | |

| Sustaining Capital Mining | – | |

| Sustaining Capital Processing | 6,010,090 | |

| Sustaining Capital Tailings Storage Facility | 5,432,266 | |

| Mine Closure Costs | 5,000,000 | |

| Indirect Costs | 18,560,082 | |

| Contingency | 40,873,816 | |

| TOTAL CAPITAL COSTS | 207,081,846 |

1Mining will be conducted via contractor, all contractor capital recovery is reflected in the mining operating costs.

The economic analysis assumes that the Project will be 100% equity financed and uses parameters relevant as of September 2022, under conditions likely to be applicable to project development and operation and analyzes the sensitivity of the Project to changes in the key Project parameters. All costs have been presented in United States Dollars (US$) and wherever applicable conversion from South African Rand (ZAR) has utilized an exchange ratio (ZAR/US$) of 16.07.

Mining and treatment data, capital cost estimates and operating cost estimates have been put into a base case financial model to calculate the IRR and NPV based on calculated Project after tax cash flows. The scope of the financial model has been restricted to the Project level and as such, the effects of interest charges and financing have been excluded.

For the purposes of the PEA, the evaluation is based on 100% of the Project cash flows before distribution of profits to the equity owners. Both pre-tax and after-tax cash flows have taken 5% royalty payments into account.

At a discount rate of 5% the Project is anticipated to yield a pre-tax IRR of 34% with a NPV of US$632,739,693, and an after tax IRR of 28% with a NPV of US$390,982,730. Cumulative cash flows are US$1,110,393,637 pre-tax and US$698,691,741 after tax over the sixteen year Life of Mine (Table 8).

The Project is expected to pay back initial capital within the first 3.2 years.

Sensitivity Analysis

Pre Tax NPV at Range of Operating Costs

| Discount | 60% | 70% | 80% | 90% | 100% | 110% | 120% | 130% | 140% |

| 5% | $1004.5M | $911.6M | $818.6M | $725.7M | $632.7M | $539.8M | $446.8M | $353.9M | $261.0M |

| 7% | $822.6M | $744.0M | $665.4M | $586.8M | $508.3M | $429.7M | $351.1M | $272.5M | $193.9M |

| 8% | $745.8M | $673.3M | $600.8M | $528.3M | $455.8M | $383.3M | $310.8M | $238.4M | $165.9M |

| 9% | $676.9M | $609.9M | $542.9M | $475.9M | $408.9M | $341.9M | $274.9M | $207.9M | $140.9M |

| 10% | $615.0M | $552.9M | $490.9M | $428.8M | $366.8M | $304.8M | $242.7M | $180.7M | $118.6M |

| Pre-Tax NPV at Range of Capital Costs | |||||||||

| $ 124.2 | $ 145.0 | $ 165.7 | $ 186.4 | $207.1M | $ 227.8 | $ 248.5 | $ 269.2 | $ 289.9 | |

| Discount | 60% | 70% | 80% | 90% | 100% | 110% | 120% | 130% | 140% |

| 5% | $708.0M | $689.2M | $670.4M | $651.5M | $632.7M | $613.9M | $595.1M | $576.3M | $557.5M |

| 7% | $580.9M | $562.8M | $544.6M | $526.4M | $508.3M | $490.1M | $471.9M | $453.7M | $435.6M |

| 8% | $527.3M | $509.4M | $491.6M | $473.7M | $455.8M | $437.9M | $420.1M | $402.2M | $384.3M |

| 9% | $479.2M | $461.6M | $444.1M | $426.5M | $408.9M | $391.3M | $373.7M | $356.1M | $338.5M |

| 10% | $436.0M | $418.7M | $401.4M | $384.1M | $366.8M | $349.5M | $332.2M | $314.9M | $297.6M |

| Pre-Tax NPV at Basket Price Levels | |||||||||

| Discount | $70 | $75 | $80 | $85 | $92 | $95 | $100 | $105 | $110 |

| 5% | $240.1M | $330.8M | $421.5M | $512.3M | $632.7M | $693.7M | $784.4M | $883.2M | $965.9M |

| 7% | $177.2M | $253.7M | $330.2M | $406.7M | $508.3M | $559.7M | $636.2M | $719.4M | $789.2M |

| 8% | $150.9M | $221.3M | $291.8M | $362.3M | $455.8M | $503.2M | $573.6M | $650.3M | $714.6M |

| 9% | $127.4M | $192.5M | $257.5M | $322.5M | $408.9M | $452.6M | $517.6M | $588.4M | $647.7M |

| 10% | $106.5M | $166.6M | $226.8M | $286.9M | $366.8M | $407.2M | $467.4M | $532.8M | $587.6M |

| Pre-Tax NPV at Varying Recovery Ranges | |||||||||

| Discount | 43% | 48% | 53% | 57% | 59% | 61% | 64% | 69% | 74% |

| 5% | $178.0M | $320.1M | $462.2M | $575.9M | $632.7M | $689.6M | $774.9M | $917.0M | $1059.1M |

| 7% | $124.8M | $244.6M | $364.5M | $460.3M | $508.3M | $556.2M | $628.1M | $747.9M | $867.7M |

| 8% | $102.6M | $213.0M | $323.4M | $411.7M | $455.8M | $500.0M | $566.2M | $676.6M | $787.0M |

| 9% | $82.9M | $184.8M | $286.6M | $368.1M | $408.9M | $449.6M | $510.8M | $612.6M | $714.5M |

| 10% | $65.3M | $159.5M | $253.7M | $329.1M | $366.8M | $404.5M | $461.0M | $555.2M | $649.4M |

Recommendations

This PEA was based on the Mineral Resource Estimate produced by The MSA Group in 2021. Significant upside potential exists down dip of Area 4 and Area 2B as well as along the several kilometer long strike extensions of the mineralization in Areas 2 and 5. Therefore, with further exploration the run-of-mine and/or life time of the Lofdal mine could be significantly increased.

Sorting of the run-of-mine material was excluded from this PEA. However, historical and recent test work at TOMRA showed several approaches for an optimization of the Lofdal mine. Further studies will focus on three run-of-mine streams which will entail (1) higher grade material directly supplied to the flotation circuit while (2) lower grade material will run through a low filter XRT sorting with an upgrade factor expected in the range 2.0-2.5, and (3) very low grade (stockpile) material which will be XRT sorted with a high filter aiming at upgrades factors in the range 3.5-4 with relatively low recoveries around 50%. The latter will also source about 13 Mt of stockpile material which is not included in the current PEA.

While completing this PEA, further flotation tests are continuing at SGS aiming at further optimization of flotation. Specifically, grind size and collector dosage optimization bears significant upside for better recoveries and lower OPEX.

Work Program with JOGMEC

Under terms of the agreement, JOGMEC has completed a non-refundable $3,000,000 work program with the objective of doubling the current mineral resource size through the provision of 7,700 meters of diamond drilling at Area 4. The program also investigated two exploration targets outside of Area 4 with 1,500 m of diamond drilling and will further investigate optimization of the processing flow sheet with specific metallurgical test programs. JOGMEC also retains the right to accelerate spending and in this regard has elected to move on to Term 2 of the JV Agreement with an additional budget funding commitment of $2,463,000. This brings the total funding commitment up to $7,000,000.

Development of a starter pit at Area 4 for bulk sample extraction

Hard rock blasting was subcontracted to the international specialist group Bulk Mining Explosives (BME) to develop a starter pit in the central part of the Area 4 deposit (Figure 3). A box cut of 60 m x 20 m and to 15 m depth was excavated and 30,000 t of material stockpiled with 7,000 t from 12 to 15 m depth regarded as fresh material for the production of the blended sample for further test work. A 550 t blended ore sample was produced with a TREO grade of approximately 0.18% TREO which is expected to represent a typical run-of-mine below oxidation level of the entire Lofdal deposit.

Bulk samples were sent to TOMRA (Hamburg, Germany) and Rados (Johannesburg, South Africa) for sorting tests. Further, samples went to Geolabs (South Africa) for geotechnical tests.